How the Pandemic is Fueling Digital Transformation for Businesses

In his more than 20 years leading General Electric as chairman and CEO, Jack Welch saw — and led — the company through a lot of changes. And there were plenty of changes that fueled big payoffs. When Welch took the helm in 1981, GE was valued at $14 billion. When he stepped down in 2001, the company was valued at $400 billion.

It’s not surprising then that an often-shared business success quote comes straight from the chairman of change himself: “Change before you have to.”

So if change can lead to big payoffs, why is it common in many business environments that the organization as a whole, down to individual employees, are resistant to change?

In simple terms, change stresses employees out.

In many work environments, employees often already feel overworked and stressed by the routine demands on the clock. When the familiar systems used to handle day-to-day tasks are disrupted, those disruptions cause more stress and often slow productivity — even if the change will, when implemented appropriately, reduce stress, improve workflows, and speed up (or in some cases even automate) tasks.

That’s often especially true when companies attempt to introduce new technologies or systems into existing work processes. Because of anticipated implementation and adoption issues — often following on the heels of big financial technological investments — many organizations have long, drawn-out processes that slow selection, set-up, implementation, and use of new technologies.

Until COVID-19.

From Office to Home

When the coronavirus sent much of the modern world into social distancing and quarantines in early 2020, businesses across all industries were united by a single goal — adapt, and adapt quickly.

For many, that meant setting up remote teams almost overnight. And with that came a nightmare list of challenges, ranging from hardware allocation and software licensing to data security and privacy issues.

For companies accustomed to doing business at brick-and-mortar locations, the challenges weren’t just about software and equipment. They quickly expanded into workflows and process adjustments. Many that relied on face-to-face interactions and the physical sharing of paper files to get things done, struggled to keep up.

And even those who had evolved processes into digital systems still ran into roadblocks, usually created by legacy systems that didn’t allow the needed level of access to systems and data that traditional “in-office” workarounds often facilitated.

Today, now some ten months into 2020, Welch’s advice to “change before you have to,” may have never been more relevant.

Remove the Fear

Whether it’s in our personal or professional lives, many people are resistant to change because of fear. That’s why the first step in changing organizational culture to facilitate digital transformation begins with reducing — and eliminating — fear.

How can you help reduce the fear that comes with technological change? It starts at the top and then weaves its way through the rest of your organization.

Let’s say, for example, your organization realized that in light of COVID-19 and your newly remote teams, your core operational systems don’t communicate with one another and the way you’ve traditionally delivered services just don’t work face-to-face anymore. And maybe because your teams are no longer in the office, it’s not effective to accept in-person cash or check payments, or create paper trails for work processes that could be handled digitally.

So how do you adapt?

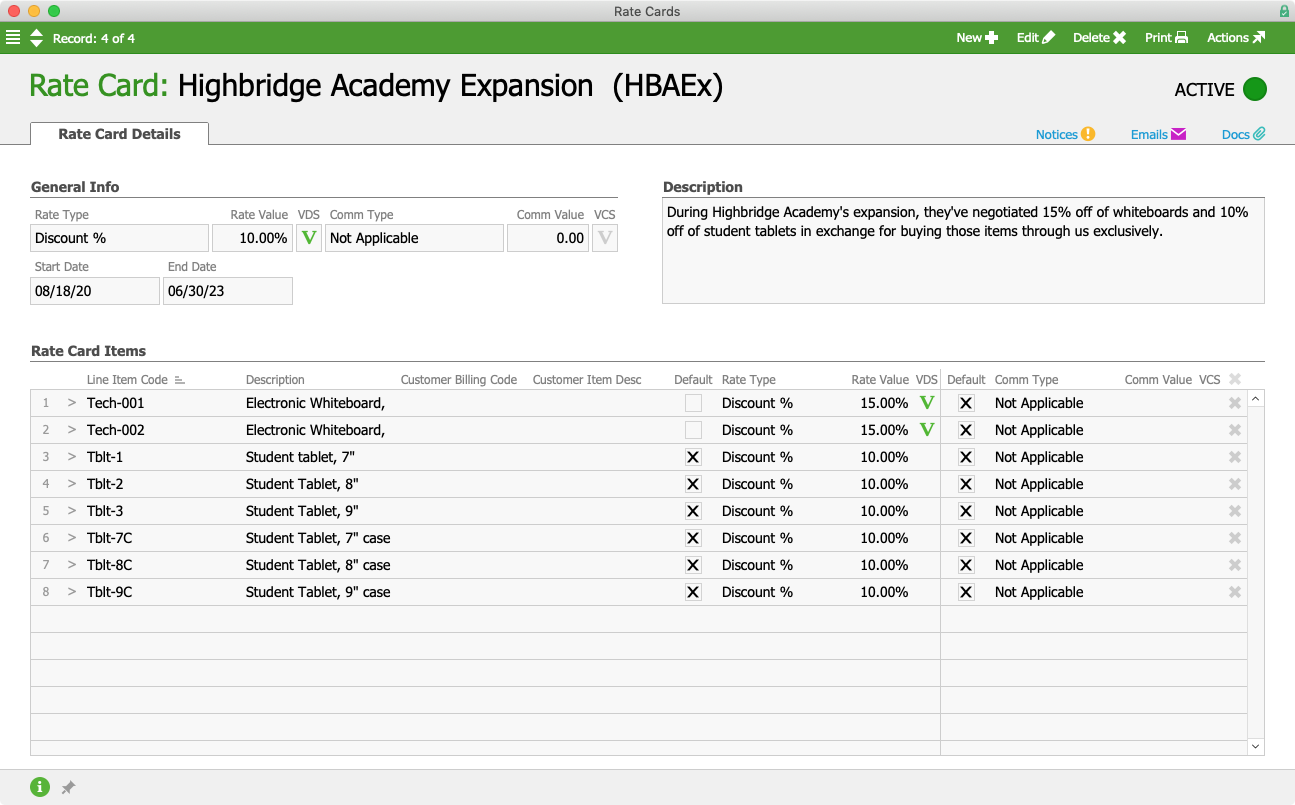

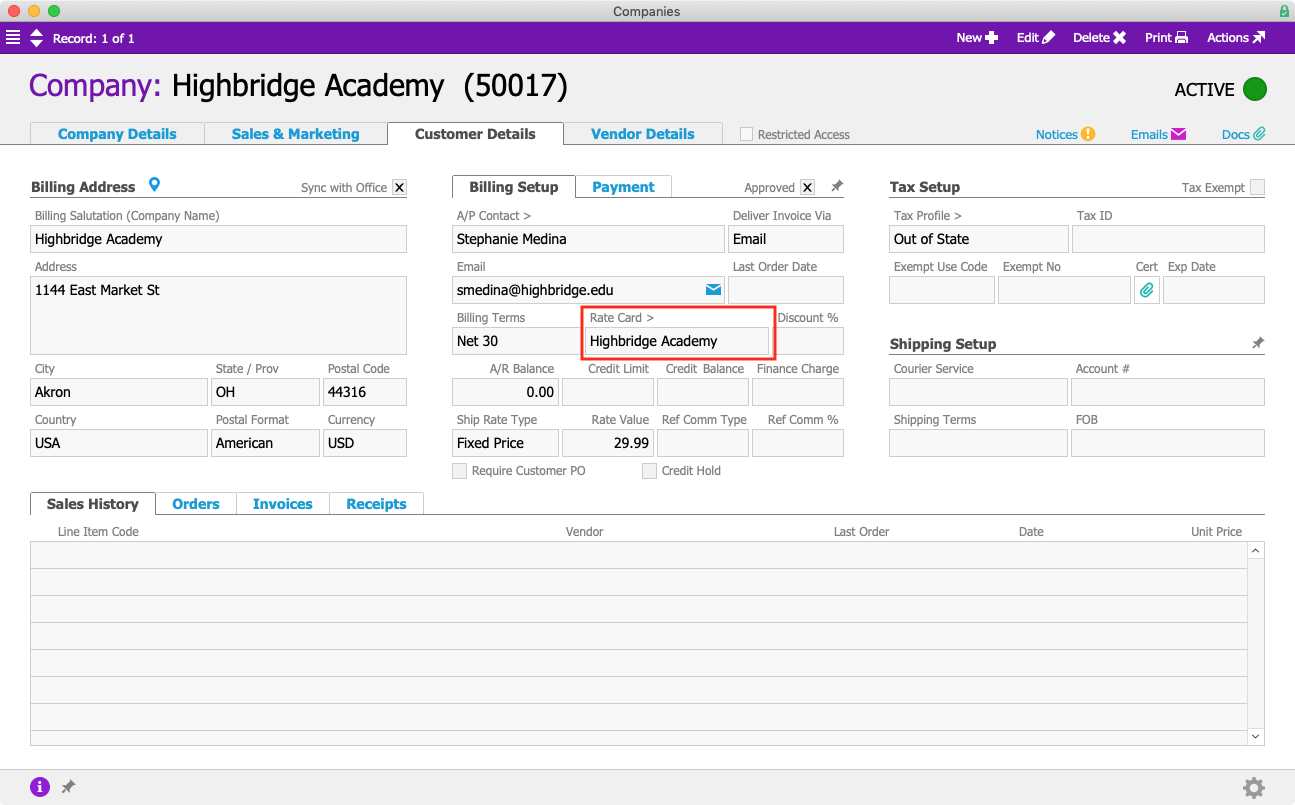

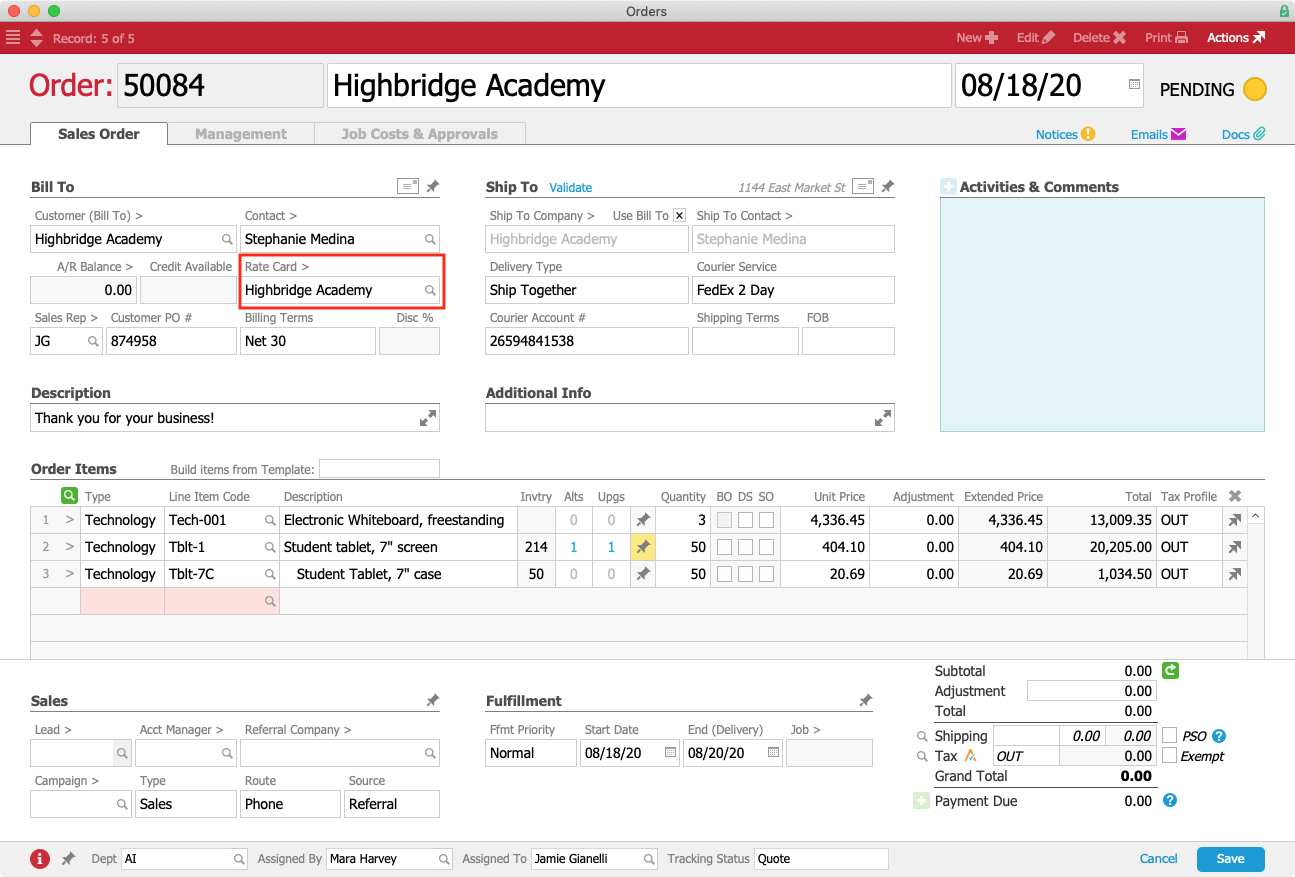

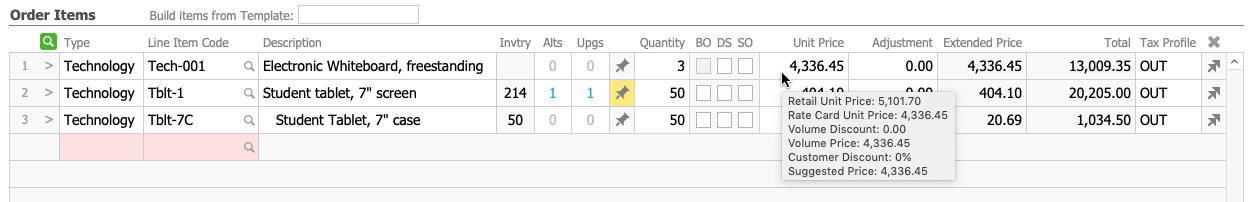

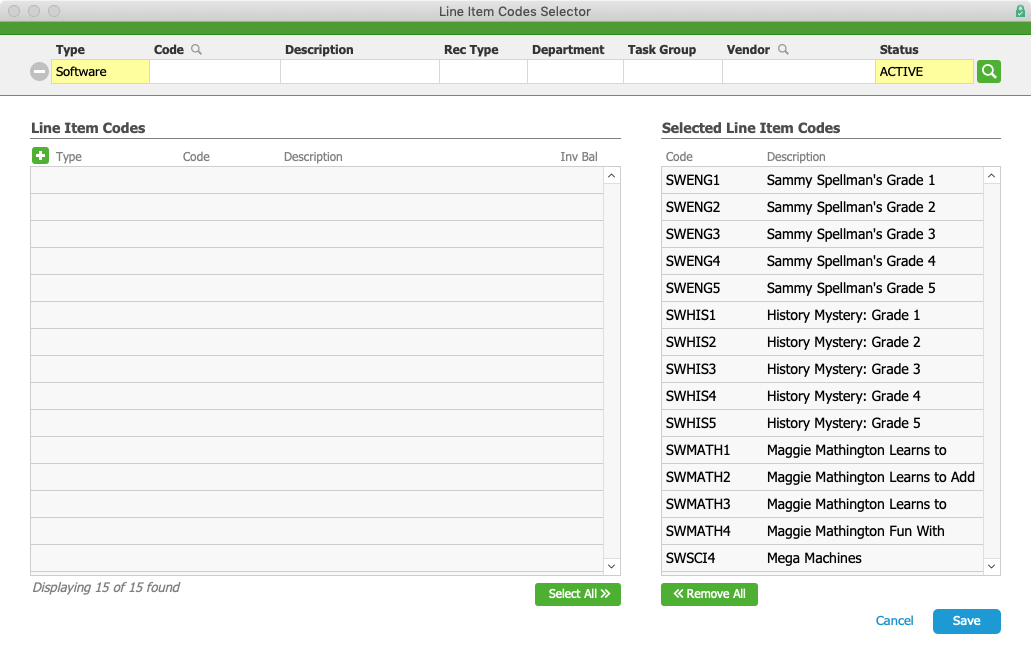

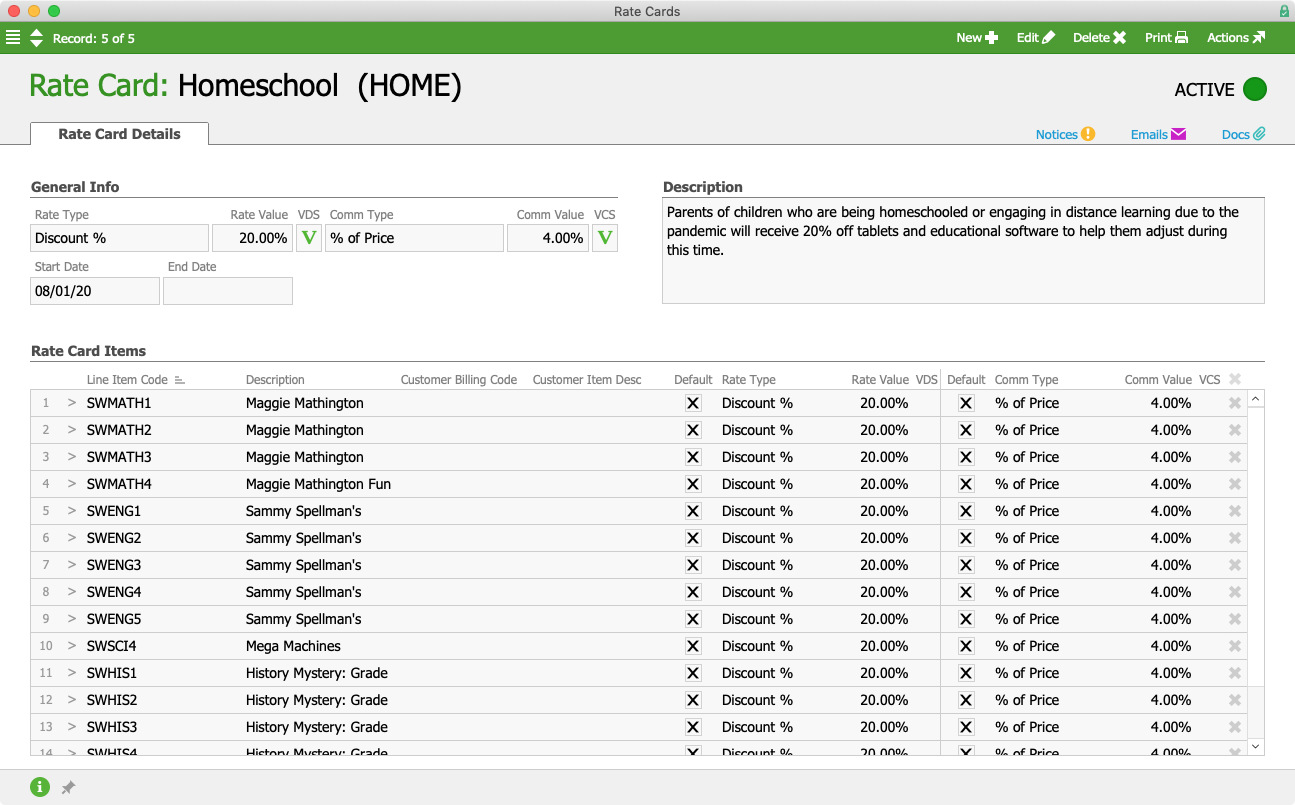

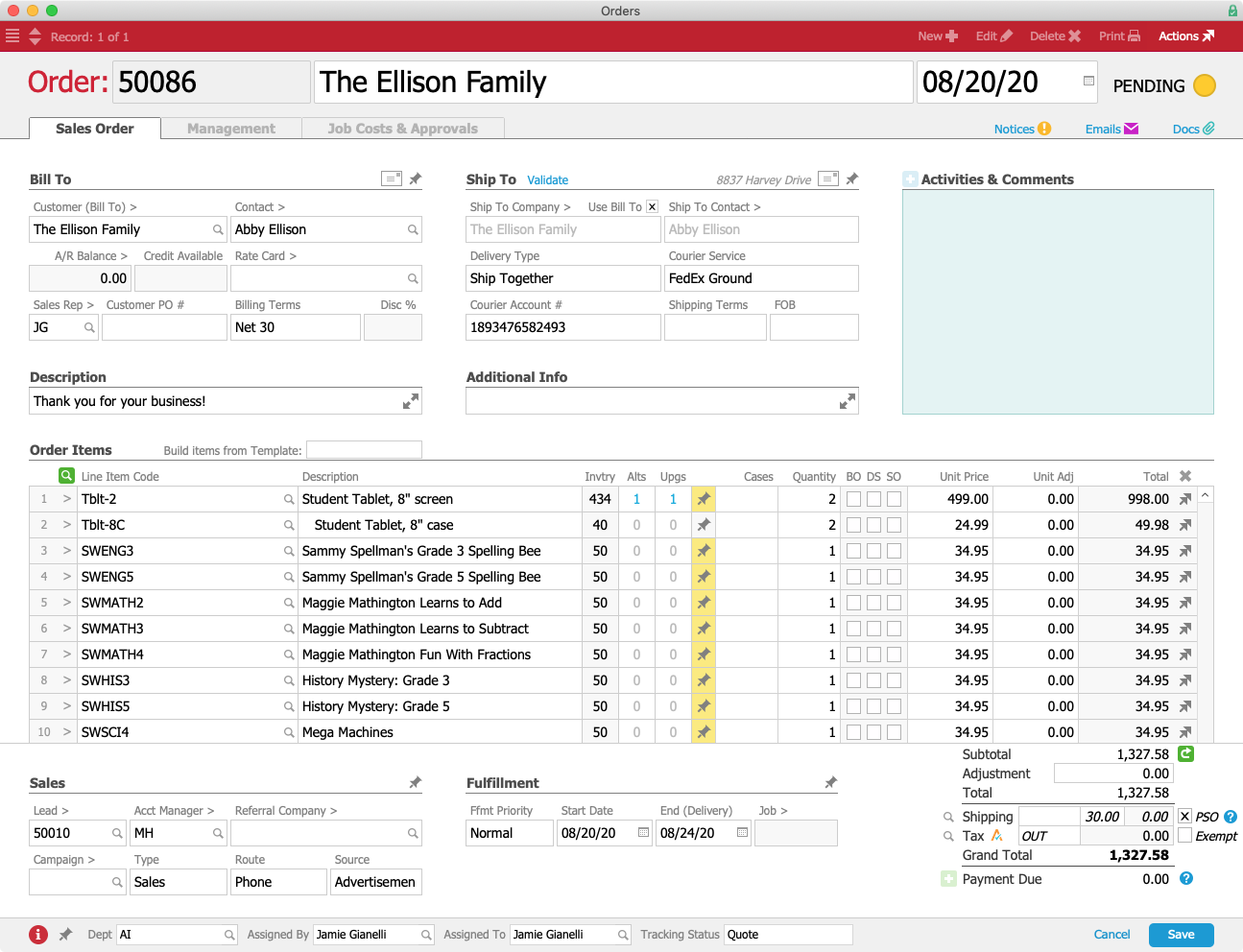

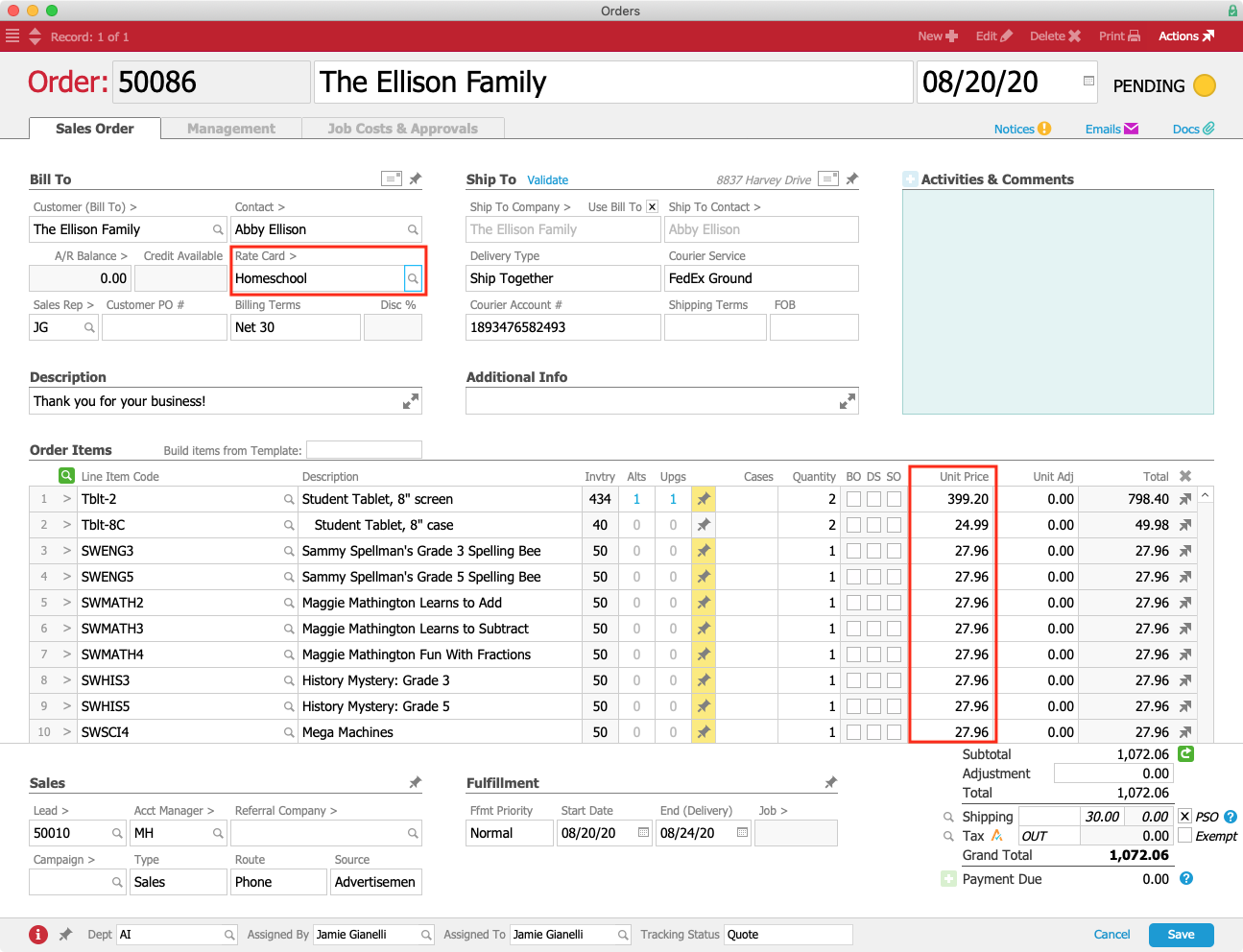

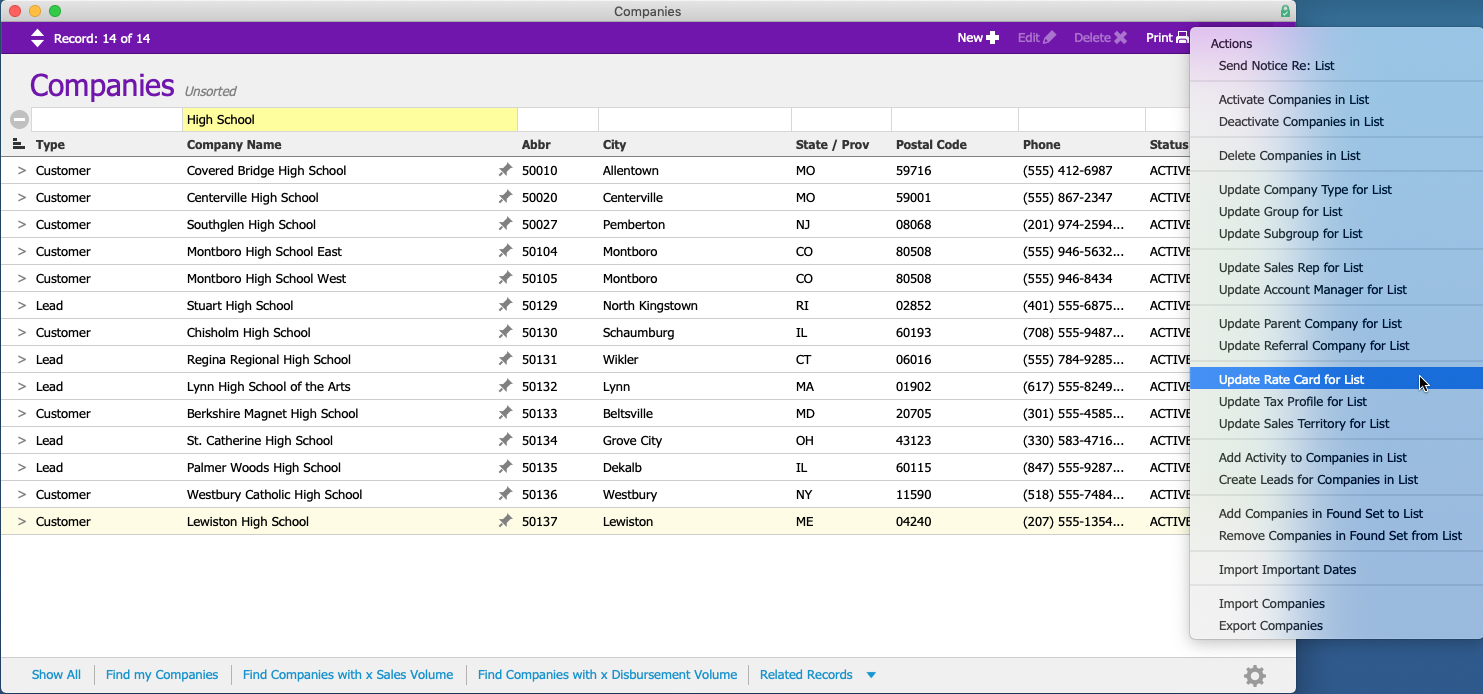

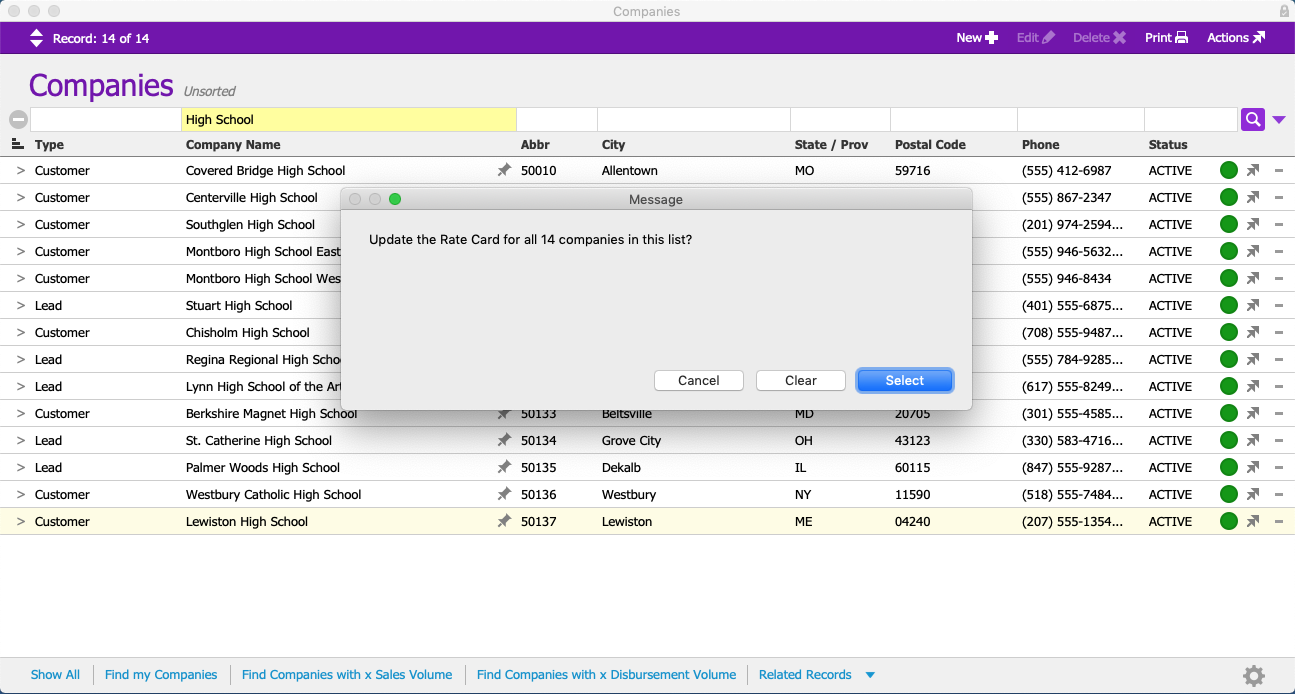

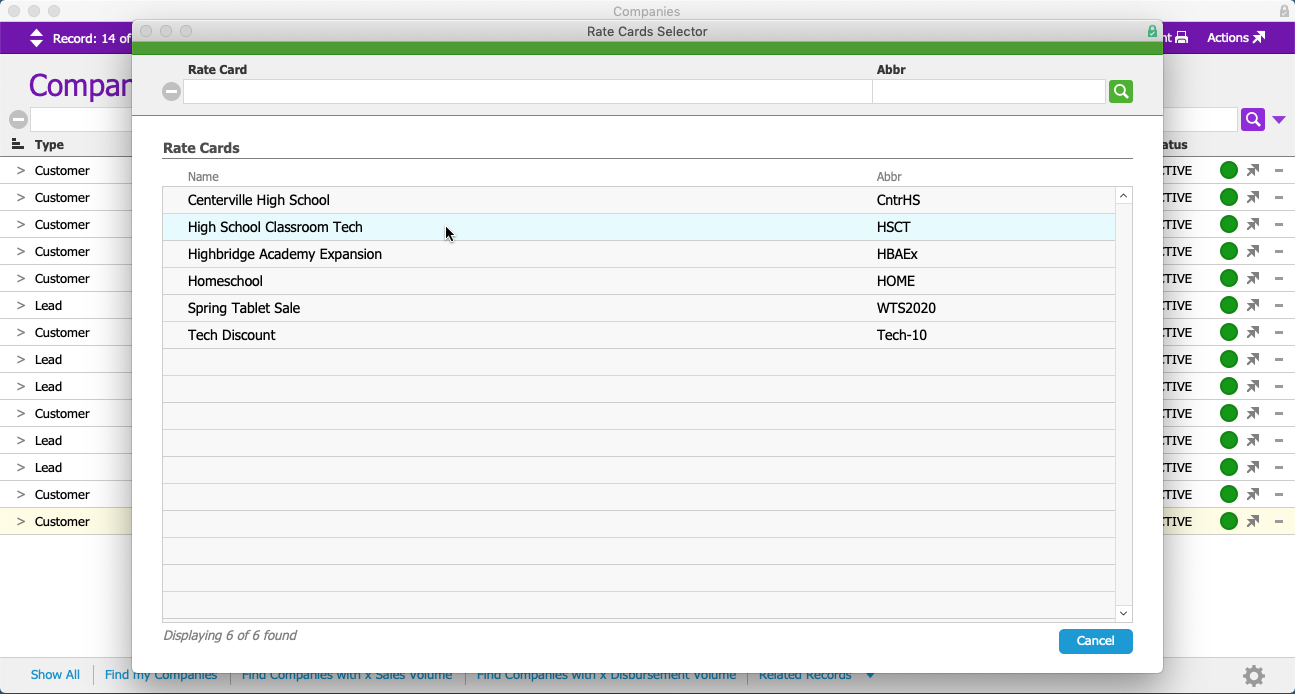

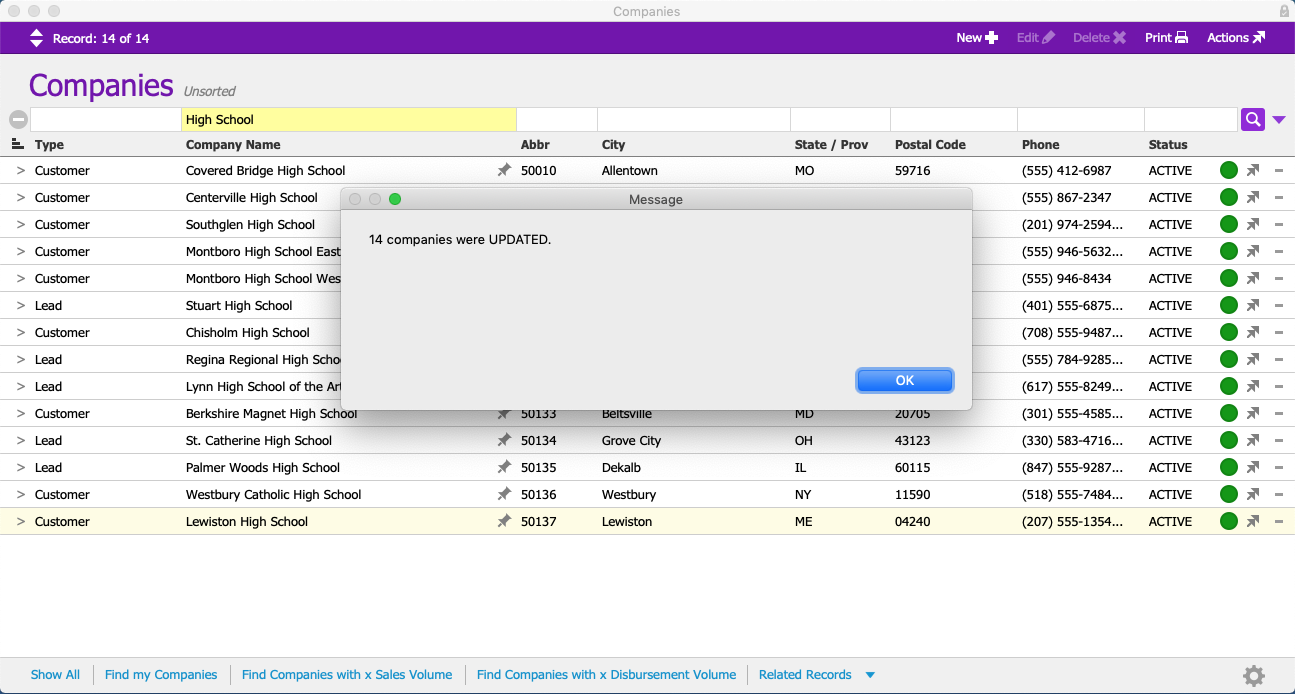

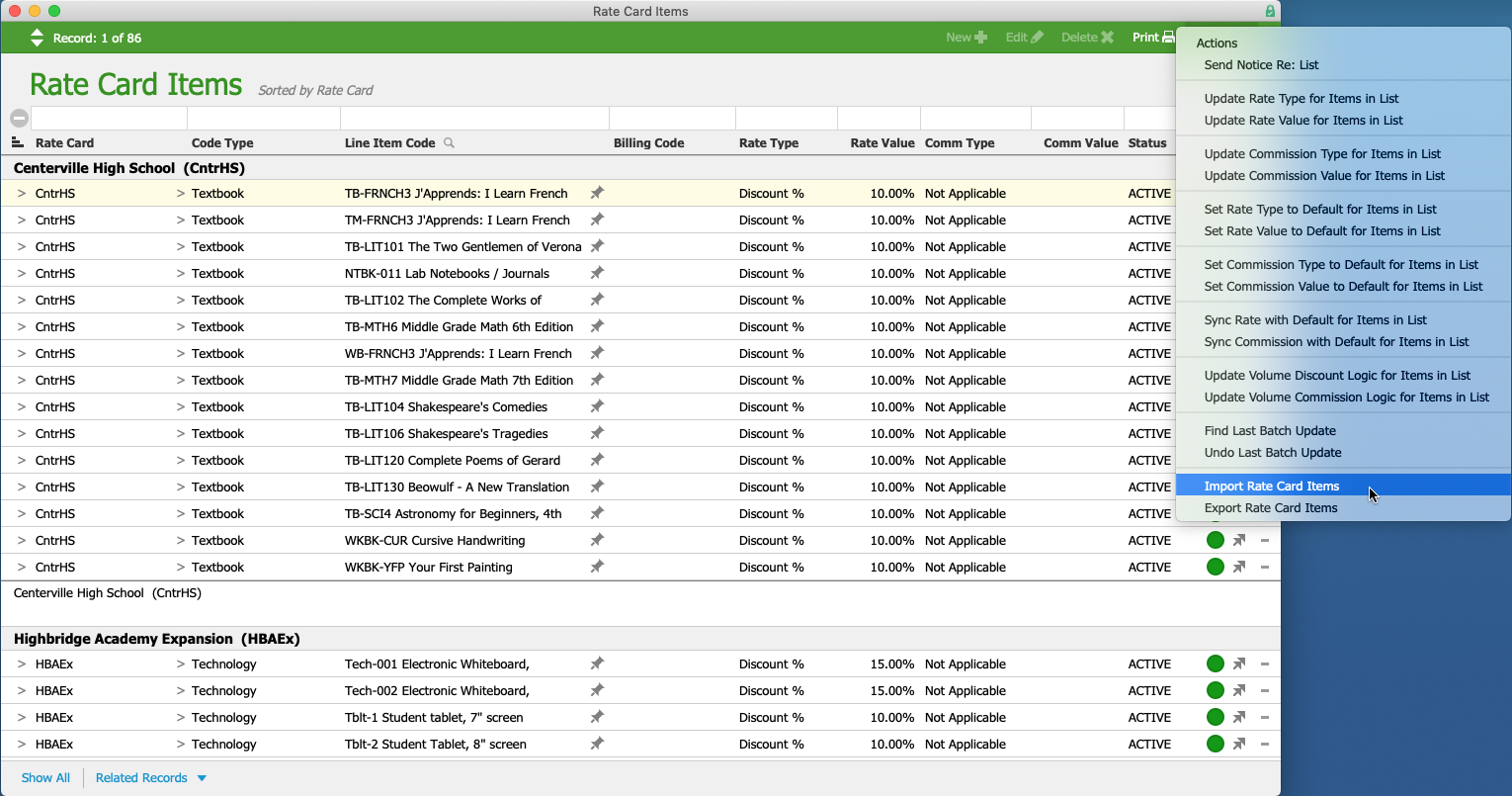

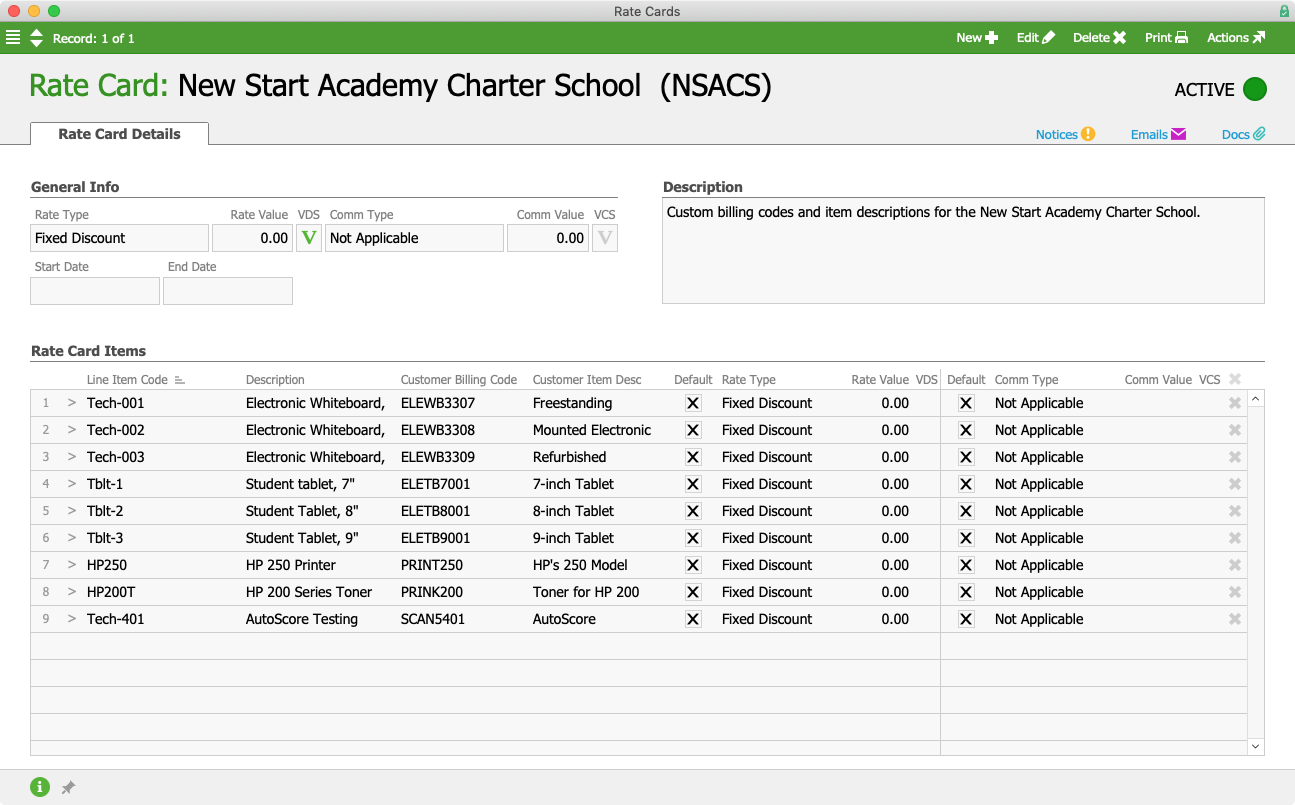

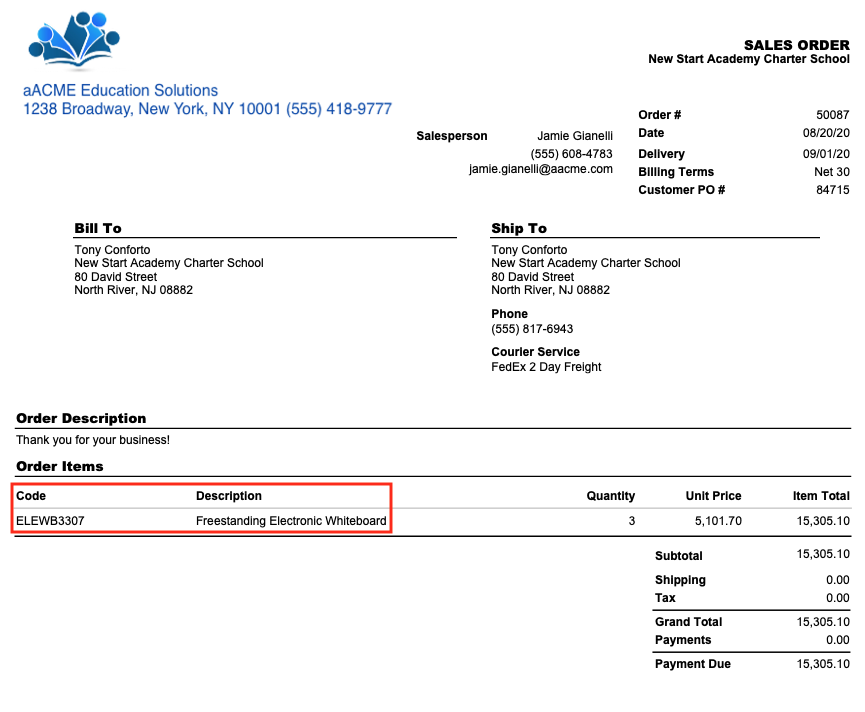

You’ll need to say goodbye to paper trails and legacy systems that silo your critical work functions and data from one another. Instead, you need a single solution that communicates throughout your entire customer acquisition process — from the moment a lead’s name and contact information is captured, through sales nurturing, to landing a deal, creating an invoice, facilitating payment, and delivering your product or goods to your new customer.

If you’re really looking to facilitate the best experience for your customers and your employees, you can even integrate everything from product development to inventory management — even shipping and receiving — all in one program that communicates the same business language for everyone.

And, lucky for you, there is a solution! A business management software system with enterprise resource planning integration can unite all of these functions for your company.

Great! Now you just have to pick one.

Get the A-Z Team

If you deputize one member of your team — and often it’s someone in IT — to go out and find the solution that does all this effectively for your company without team input, you’re probably setting yourself up for failure.

Instead, start at the top.

This digital transformation is going to affect a lot of processes, teams, and people both inside and outside of your organization (think customers, vendors, suppliers, and stakeholders, too). To be successful and help eliminate that fear of change, start at the top by finding an executive sponsor.

Your executive sponsor is going to be a mix of coach and cheerleader for your business management software (BMS). The sponsor should be poised to help you align your BMS strategies with your organizational goals and objectives, help ensure you have the adequate resources you need to be successful, facilitate risk analyses for your changes, and help communicate the importance of this change from the top (senior executives and board members) all the way through your organization. The goal here, remember, is to remove fear and breathe the change into your corporate culture.

While a leader from your IT team should absolutely be a part of your BMS team, the software selection process should not exclusively land on the shoulders of your IT staffers. Digital transformation success is definitely driven by a team approach. You’ll need cross-departmental representation of all teams that will use the technology on a routine basis as well as members whose daily tasks may be affected or changed by the new technology.

This diverse team will also help share the message of why this change is necessary and how it can improve workflows for your employees.

These team members are also going to be great at helping you foresee potential stumbling blocks across your organization so you can make plans to address and mitigate those challenges before they become adoption and usage issues.

Seek Advisors, Not Salespeople

Once you’ve assembled your team, it’s time to align your BMS objectives to your company goals, and then begin a business impact analysis to discover which of your core workflows are the most critical, what’s working great now, and what could be improved with the support of a business management solution. Are there tasks that can be automated to save time, eliminate repetition, and decrease the chance of errors?

This is also a great time to call on your executive sponsor who can help with your BIA and related risk assessments.

From there, it’s time to short-list your vendors. Your risk assessments and BIA should help you understand what you need your software to do. Now is time to pair with a business management software advisor to help you select which is best for your organization’s needs.

And there’s definitely a nuance here between finding a salesperson and an advisor. Sure, ultimately a BMS advisor is focused on selling you a solution, but a true advisor — one who is part of a company that wants to work with you — will do more than just tell you why his or her product is the right for you and then walk away when the sale is complete.

A business management software advisor should be willing to hear your needs, then explain how the solution will meet those needs. It’s not about the bells and whistles of saying “look what we can do!” It’s about showing you how the software can do what you need it to do for your company.

The advisor should also be able to help you create an implementation plan and will support you with the information you need to effectively communicate how the technology works and provide appropriate training and education for your team members.

Manage from the Middle

Once your A-Z Team has settled on a solution and you’ve worked with your advisors to get it implemented, it’s time to manage from the middle to promote company-wide buy-in. Your team members should be well versed in responding to those roadblocks you planned for during your selection process. Now, they’re ready to help encourage adoption throughout your organization.

Make it Part of Your Culture

Once you’ve gone through this process once successfully, you’ll be able to replicate it for any of the digital transformation moves you’ll need as your company scales over time. By adapting these processes and putting them to work for you as part of your organizational culture, you’ll be better prepared to handle change the next time your company experiences a significant disruption or crisis.

And, as COVID-19 has shown us, there is no better time for change than well before you have to. If you’re still mulling over whether or not it’s the right time to say goodbye to those legacy systems and paper processes, let us show you why you should. Contact us today to be put in touch with an aACE advisor who will be happy to help show you how our business management software will meet all of your organization’s needs today — and for many years to come.

Or better yet, see the software in action yourself by joining us for an upcoming webinar. Click below to see our full schedule and register now to save your seat!

"aACE helped us to bring all of our company functions together into one system. This has helped us with automating reporting and avoiding the need for extra cross-checking among systems." - Lance Caffrey, EVP Operations, American Christmas